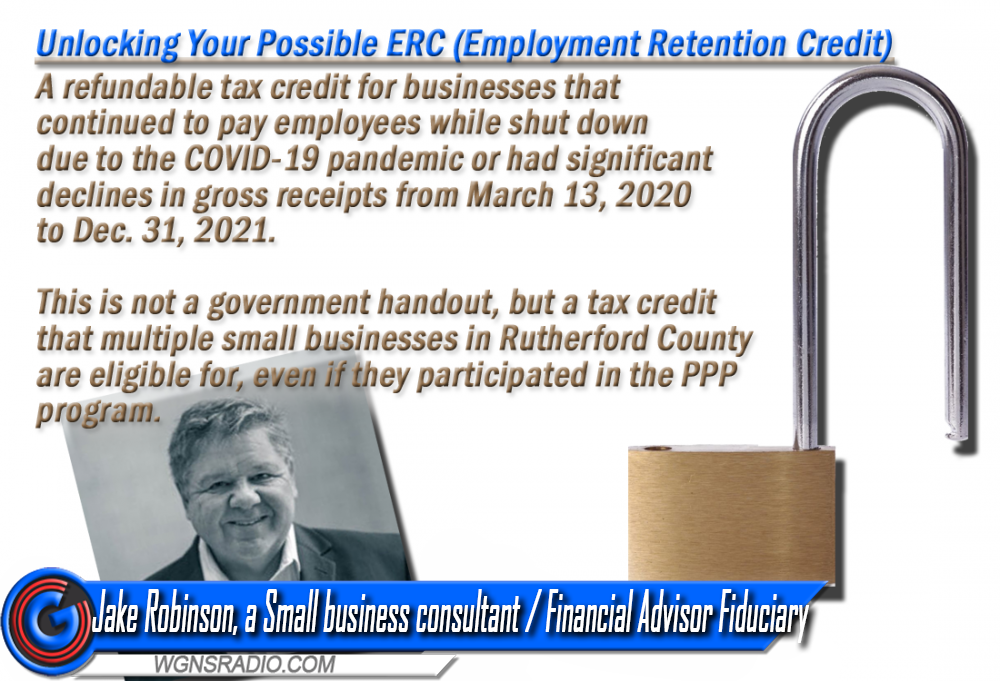

Our Action Line guest on WGNS was Jake Robinson, a small business consultant and a Financial Advisor Fiduciary. Robinson talked about homeownership, paying off your house Vs. financing a house, saving money and MOST IMPORTANTLY, helping small business owners recoup money they lost during the COVID Pandemic, even if you did or didn’t participate in the PPP program.

Today, Jake talked about the ERC Program (Employee Retention Credit) that will help to allow small business owners recoup some of the funds they may have lost during the COVID-19 Pandemic. The program is for all small businesses, even the businesses that received PPP Funds under the CARES Act. In other words, just because you received money during the pandemic in the form of the PPP (Paycheck Protection Program), it definitely doesn’t mean that you can’t receive funds through the ERC Program.

To learn more or to find out if your business can receive the ERC tax credit – Click Here.

Examples of what Jake Robinson’s company will look at to see if your small business qualifies is:

- Did you have to pay employees more to retain them?

- Did you have to pay INCREASED fees for your retail items?

- Did you have to pay more for FOOD if you are a restaurant owner?

- Did you have to pay INCREASED Fees for Delivery of goods?

- Did you have to pay more for toilet paper, paper towels, cleaning supplies, etc?

- The list goes on and on!

When you talk to Jake, tell him that you heard about this program on WGNS Radio!

Forbes article about ERC:

Jake's Contact Information:

EMAIL: jake@terrawealth.com

PHONE: 615-249-4523