Tennessee Residents have a somewhat high credit card balance.

Despite the dropping trend, the average credit card balance remains high in some states and will likely increase during the holiday season.

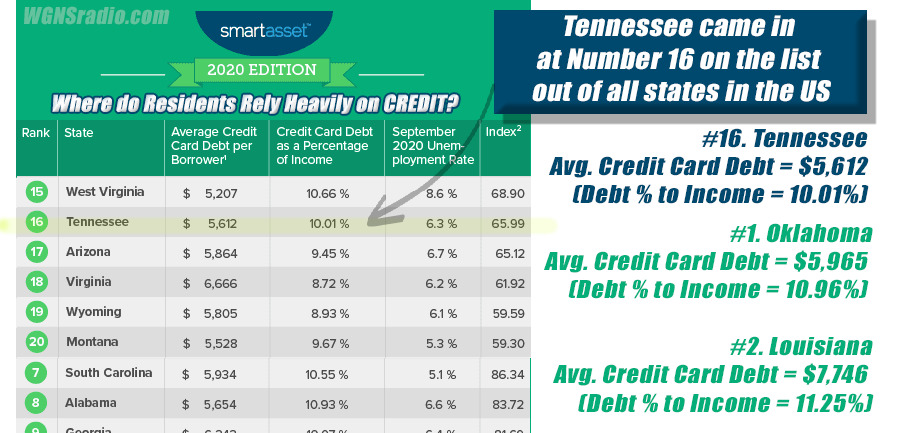

A recent and new study by SmartAsset analyzed data from the Census Bureau and Experian for all 50 states and D.C. to find the places where residents tend to rely on credit the most. Tennessee cracks the top half of the list.

In the Volunteer State, the average debt to income ratio comes in at 10.01%. The average credit card debt of Tennesseans rings in at $5,612. At the time of study, the unemployment rate for Tennessee was 6.3%. Today, the jobless rate is even higher at 7.4% for Tennessee residents.