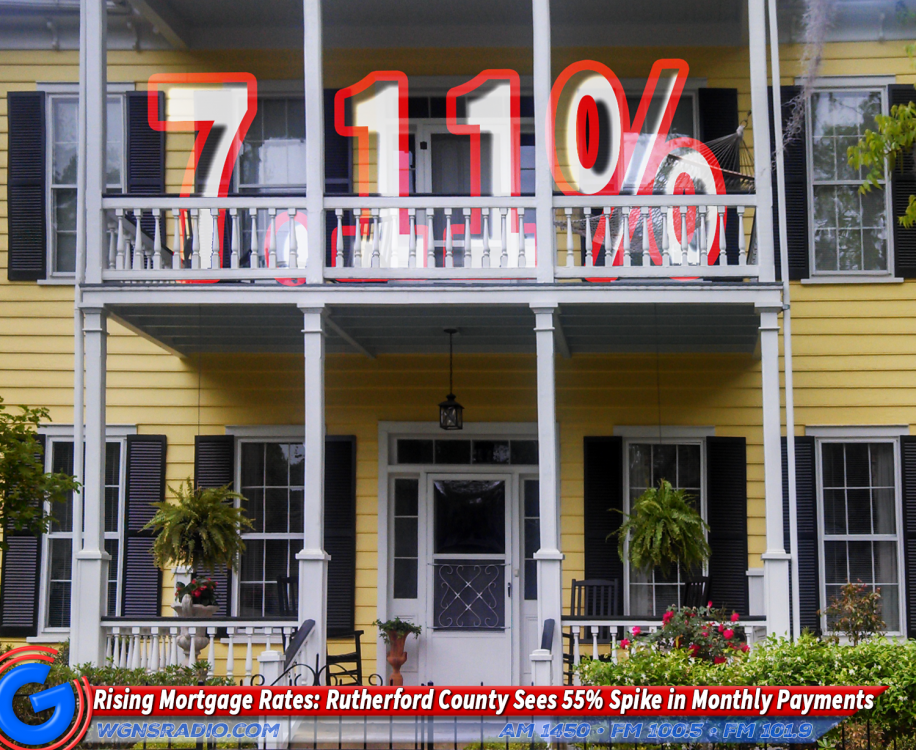

RUTHERFORD COUNTY, TN - The road to homeownership in Tennessee has grown increasingly steep over the past few years, with recent data revealing a sharp rise in mortgage payments due to soaring interest rates. While home prices in many parts of the state have held relatively steady since 2022, the cost of borrowing has surged, placing significant strain on both new and current homeowners.

Rate hikes are quite evident in Rutherford County, where the average monthly mortgage payment has jumped 54.7%, increasing by $812 MORE per month. In 2022, a median-priced home in the Murfreesboro, Smyrna, or LaVergne area cost around $1,483 per month to finance. Today, that same mortgage comes with a payment of $2,295 per month—a difference driven almost entirely by increased interest rates for a home that is nearly the exact same price.

This trend is mirrored across Tennessee. In Chattanooga, homeowners are paying 79.4% more, with the average mortgage up $788 per month. The Kingsport-Bristol region saw a 76.4% increase, while Knoxville matched Chattanooga with a 79.4% spike.

Even in smaller cities like Cleveland, TN, residents are grappling with a 66% jump, pushing the average monthly mortgage from $906 in 2022 to $1,510 in 2025.

In Memphis, the impact has been somewhat less severe, but still substantial, with monthly payments up 53.4%. These sharp increases coincide with a broader national trend where the average 30-year fixed mortgage rate has risen from 3.8% in 2022 to 6.8% in 2025—an 80% increase that marks the highest rates seen since 2002. Despite modest declines from the late 2023 peak of 7.6%, interest rates remain more than 2.5 times higher than during the historic lows of 2021, putting Tennessee families under mounting financial pressure as they try to secure the American dream of homeownership.

The 2025 edition of Construction Coverage’s U.S. Cities Most Impacted by High Interest Rates report explores where buyers have been hit hardest by the jump in borrowing costs. Researchers ranked locations by the percentage change in the hypothetical monthly mortgage payment for a median-priced home between February 2022 and February 2025 (the latest three-year period with available data).

How Mortgage Costs Have Changed in Tennessee

- Nationwide, Mortgage Rates Have Nearly Doubled: The average U.S. mortgage rate has climbed 80% since 2022—from 3.8% to 6.8%.

- Payments Are Rising in Tennessee: The median home price in Tennessee climbed from $277,518 in 2022 to $316,501 today. Taking this median home price and the average 30-year fixed mortgage interest rate together, estimated monthly mortgage payments in Tennessee have increased by 61.0% in just three years.

- Tennessee Homebuyers Pay $628 More Today: In 2022, buyers in Tennessee faced an estimated monthly mortgage payment of $1,029 for a median-priced home. Prospective homebuyers today, however, face payments of $1,657 per month.

- How Tennessee Compares Nationally: Overall, prospective homebuyers in Tennessee have experienced a larger increase in monthly mortgage payments since 2022 (+61.0%) than the nation has as a whole (+59.0%).

While mortgage rates have risen nationwide, their effect on home prices has varied by region. Western states like California and Arizona saw price declines between 2022 and 2023, followed by little to no growth. Meanwhile, East Coast states such as Connecticut, New Hampshire, and New Jersey experienced steady appreciation, leading to some of the sharpest increases in mortgage payments—over 70% in many cases. In contrast, parts of the South and West, including Idaho and Louisiana, saw more modest increases in payments (40% or less), largely because they had already experienced significant price surges earlier in the pandemic from 2020 to 2022.

- See more details HERE.