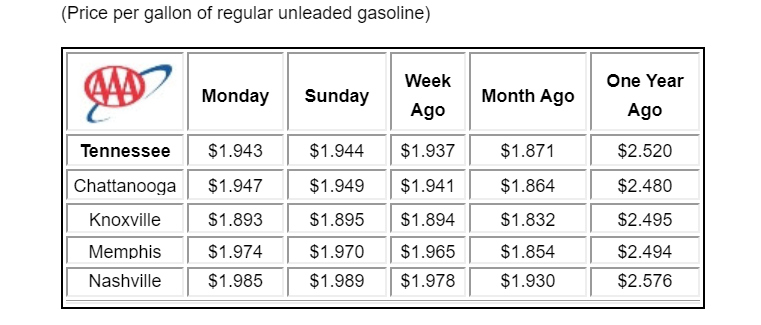

Tennessee Regional Prices

- Most expensive metro markets – Nashville ($1.99), Memphis ($1.97), Morristown ($1.96)

- Least expensive metro markets – Johnson City ($1.87), Kingsport ($1.88),

The Tennessee gas price average holds steady for the second week at $1.94. The Tennessee Gas Price average is seven cents more than one month ago and 60 cents less than one year ago.

Quick Facts

- 90% of Tennessee gas stations still have prices below $2.00

- The lowest 10% of pump prices are $1.77 for regular unleaded

- The highest 10% of pump prices are $2.22 for regular unleaded

- Tennessee is the 9th least expensive market in the nation

National Gas Prices

Gasoline demand increased on the week to the highest level (8.7 million b/d) since March as stocks decreased, but the combination wasn’t enough to significantly impact gas price averages across the country. On the week, the national gas price average only increased one penny to land at $2.19. That is nine cents more than last month and nearly 60 cents less than a year ago.

From May to early July in 2019, gasoline demand averaged 9.5 million b/d. For the same time period this year, demand is measuring at 8 million b/d while gasoline stocks sit, on average, at a 24 million bbl surplus. The low demand and high supply are keeping gas prices relatively cheap for the summertime.

National Oil Market Dynamics

At the end of Friday’s formal trading session, WTI increased by 93 cents to settle at $40.55 per barrel. Domestic crude prices were volatile last week after EIA’s weekly report revealed that total domestic crude inventories increased by 5.7 million bbl to 539.2 million bbl. Increasing crude stocks could mean that crude production is still too high given where demand is currently, as new coronavirus outbreaks emerge. If EIA’s data shows another increase in total domestic supply this week, crude prices could decline.