While homeownership has been on the rise since 2016, and early data suggests it could be surging during COVID-19, the national homeownership rate remains below peak levels and out of reach for many Americans. Prior to the pandemic, approximately 36% of households in the U.S. were renter-occupied and 64% were owner-occupied, but in certain areas renters significantly outnumber homeowners.

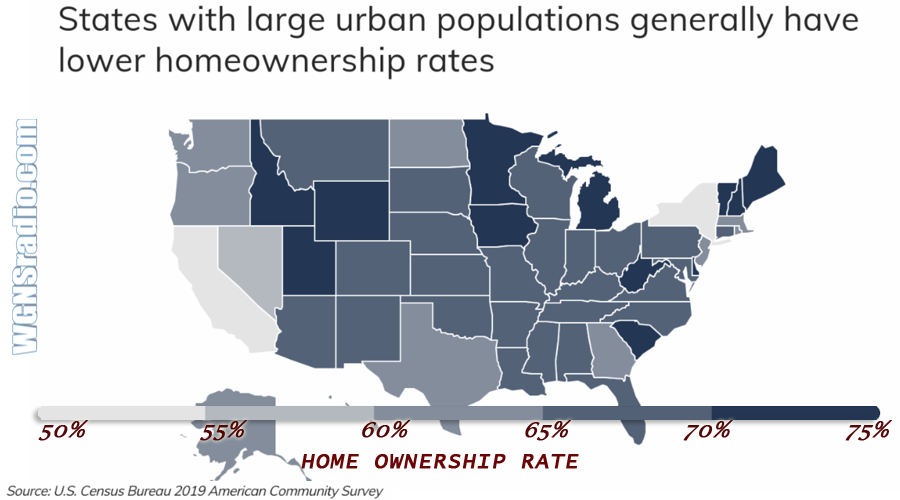

To find which states have the lowest homeownership rates (and the most renters), researchers at Roofstock analyzed housing data from the U.S. Census Bureau 2019 American Community Survey 1-Year Estimates. All housing data presented below comes from 2019, when the homeownership rate nationwide was 64.1%.

The analysis found that in Tennessee, 66.5% of all homes are owner-occupied while renters occupy the other 33.5%. Owner-occupied households in Tennessee report a median household income of $69,970, compared to just $36,565 for renters.

Here is a summary of the data for Tennessee:

Owner-occupied housing units: 1,765,720

Renter-occupied housing units: 889,017

Median household income (owners): $69,970

Median household income (renters): $36,565

Median home price: $196,125

For reference, here are the statistics for the entire United States:

Homeownership rate: 64.1%

Owner-occupied housing units: 78,724,862

Renter-occupied housing units: 44,077,990

Median household income (owners): $81,988

Median household income (renters): $42,479

Median home price: $256,663

It looks as if a long period of low housing inventory has driven up prices and made it more difficult for the average worker to afford a home. Data from Zillow shows that the current median home price nationwide is $256,663, pricing many Americans out of the housing market. In fact, the national median household income for a homeowner is $81,988, nearly twice the median household income of a renter ($42,479).

As a result of geographic differences across these factors, homeownership rates vary significantly by location. At the state level, homeownership rates range from a low of 53.5% in New York to 73.4% in West Virginia. In general, coastal states with expensive and densely populated urban areas, such as New York and California, tend to have some of the lowest homeownership rates in the country. By contrast, many states in the Midwest such as Minnesota and Wyoming are known for their affordable housing, and tend to have higher homeownership rates.

For more information, a detailed methodology, and complete results, you can find the original report on Roofstock’s website: https://learn.roofstock.com/