Tennessee Sees Above-Average Investment in Manufactured Housing as Affordability Squeeze Continues

NASHVILLE, Tenn. — With home prices, mortgage rates, and rents still elevated, Tennessee is leaning more heavily on manufactured housing to expand affordable options for residents. A new analysis from Construction Coverage shows the Volunteer State outpacing the national average in new manufactured homes and posting one of the nation’s higher shipment totals.

In 2024, 11.2% of all new single-family houses built in Tennessee were manufactured homes, compared to 9.5% nationally. The state shipped 4,120 manufactured homes—the 8th most among U.S. states—while permitting 32,660 traditional site-built single-family homes over the same period. Pricing underscores why interest is growing: manufactured homes in Tennessee sold for an average of $130,200 last year, versus a $333,626 median price for all single-family homes.

Manufactured housing (factory-built and transported to final sites) offers comparable quality at far lower construction costs—roughly $87 per square foot versus $166 for site-built homes—helping lower- and middle-income households close the gap between wages and housing costs. Nationwide, more than 22 million Americans now live in manufactured homes, and the segment accounts for about 1 in 10 new homes built each year.

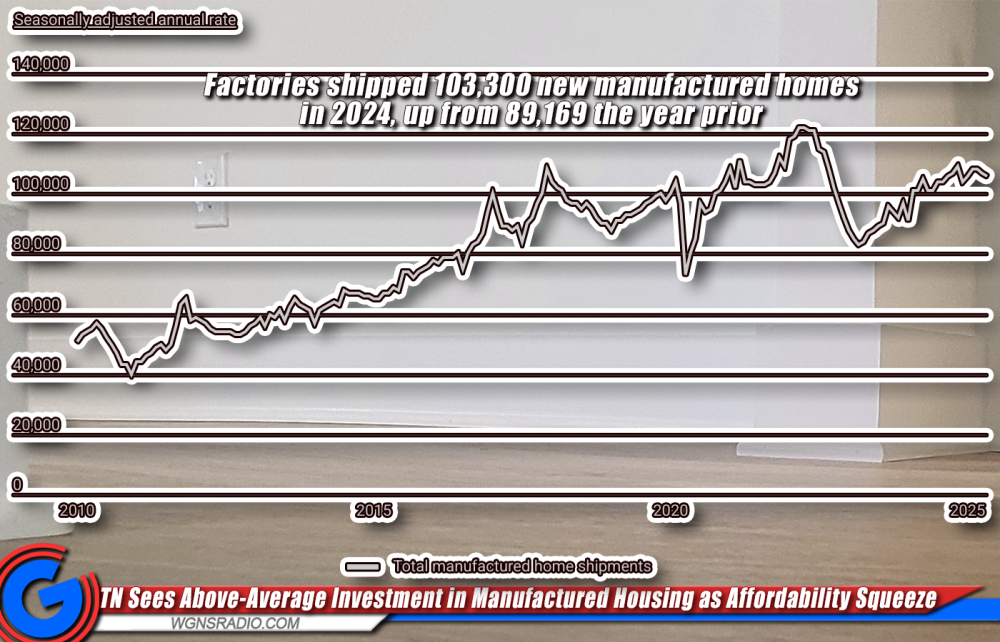

After a dip in 2023, the sector is rebounding: U.S. shipments rose to 103,300 units in 2024, and by mid-2025 the annual shipment rate had climbed to 106,000. Nationally, the average manufactured home sold for $123,300 in 2024, while the median single-family home value reached $367,282 (land excluded for the manufactured comparison). The South remains the epicenter of manufactured housing activity, with states like Texas and Florida leading total shipments and others—such as Mississippi and Kentucky—posting some of the highest shares of manufactured homes among new builds.

In Tennessee, industry observers point to persistent affordability pressures, steady demand in fast-growing metros and rural counties, and local policy shifts that are gradually easing zoning barriers. While land costs, financing terms, and local development standards still shape what’s possible on a site-by-site basis, the latest numbers suggest manufactured housing is poised to play a larger role in meeting the state’s housing needs.

Key Findings for Tennessee

- Above-average investment in manufactured housing: In 2024, 11.2% of all new single-family houses built in Tennessee were manufactured homes, compared to 9.5% nationally.

- Manufactured vs. site-built: Tennessee shipped 4,120 manufactured homes last year, the 8th most of any state, and issued 32,660 permits for single-family site-built homes.

- Cost comparison of manufactured vs. all homes: Manufactured homes in Tennessee sold at an average price of $130,200, versus the median $333,626 for all single-family homes in 2024.

Key Findings for United States

- Manufactured home production is rebounding: After falling sharply in 2023, shipments of manufactured homes increased to 103,300 units in 2024. As of mid-2025, the annual shipment rate had climbed to 106,000—indicating a faster recovery than the broader site-built housing market.

- Manufactured homes remain significantly more affordable: In 2024, the average manufactured home sold for $123,300, while the median single-family home value reached $367,282. Despite rising prices in both segments, manufactured homes remain about 66% less expensive—though the comparison excludes land value.

- The South leads in manufactured housing investment: Southern states like Texas, Florida, and North Carolina had the highest total shipments in 2024, while states like Mississippi, Kentucky, and Louisiana had the highest share of manufactured homes among new single-family housing—often reflecting lower income levels and affordability needs.

- Policy shifts may be supporting growth: The recent uptick in manufactured home shipments may be driven by easing inflation, continued consumer demand for affordable housing, and state and local policy changes that have eased zoning restrictions and encouraged factory-built housing development.

See the full REPORT HERE.