RUTHERFORD COUNTY, TN - Rutherford County Assessor of Property Rob Mitchell told WGNS and several other media outlets in an email on Thursday (11/06/2025) that the county is paying the Tennessee Comptroller of the Treasury $236,000 to alter the local tax roll by $12,000. Mitchell stated, “We have not yet finished the work and we expect the dollar amount to change.” He continued, “It could be greater or lesser,” referring to Comptroller Jason E. Mumpower’s findings, which Mumpower presented before the full County Commission last month... The comptroller outlined errors that were found in the recording and valuation of properties in Rutherford County.

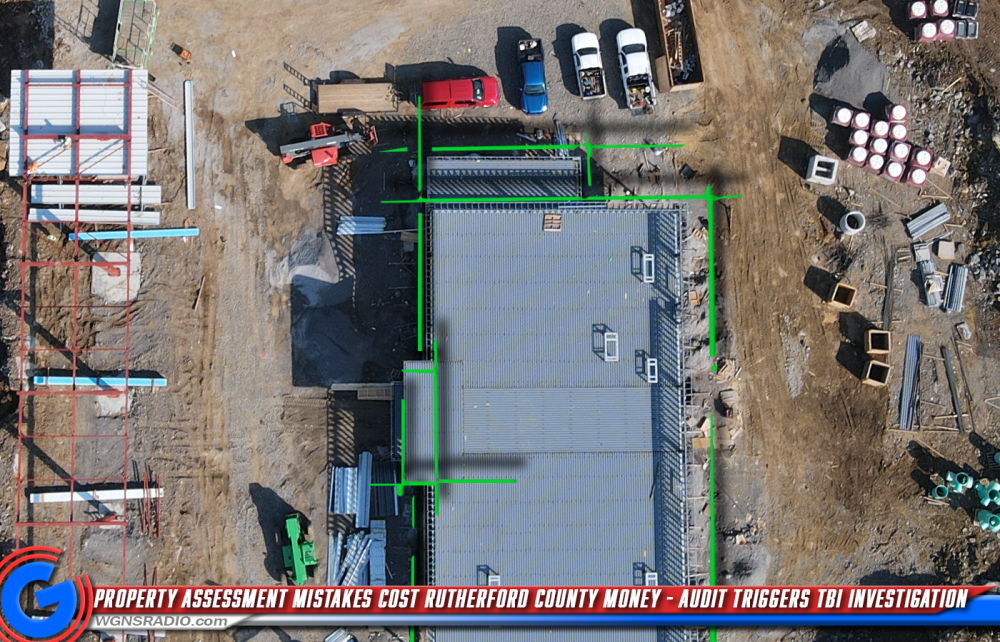

On October 16, 2025, Comptroller Mumpower stated... He further added that new construction, in particular, was completely left off the tax roll in Rutherford County. Some of that new construction included multi-family town-home developments that were never entered into the system. Other problem areas identified by Mumpower included incorrect square footage measurements for homes.

As a result of the findings, the Tennessee Bureau of Investigation is now investigating the Rutherford County Property Assessor’s Office, following a request made by 16th Judicial District Attorney General Jennings Jones. On Thursday night, the TBI's office confirmed the investigation.

While Mitchell did not comment on the DA’s involvement in Thursday’s email to WGNS, he did write, “We made mistakes, honest mistakes, as you might see in any office or business, while pursuing our ultimate goal, perfection.” He added that although the corrections represent a small percentage of the county’s roughly $310 million tax base, the goal is to reduce the error margin — which Mitchell identified as approximately $12,000 — to as close to zero as possible.

After the Comptroller most recently returned more than 2,000 accounts flagged for changes, Mitchell said that he and his staff have been working to correct the errors. His email noted that, so far, the office has re-entered data on at least 1,244 accounts. Mitchell stated, “The average dollar change per parcel is $4.90.” He closed by saying that more updates will be announced as they are made.

- Previously, Mitchell sent WGNS a detailed list of explanations regarding how he believes some of the problems occurred, pointing to the complex appraisal models that property assessment offices rely on. You can open that PDF file, which Mitchell sent to WGNS, HERE. See the original news article that includes the Oct. 16, 2025 county commission meeting, HERE.