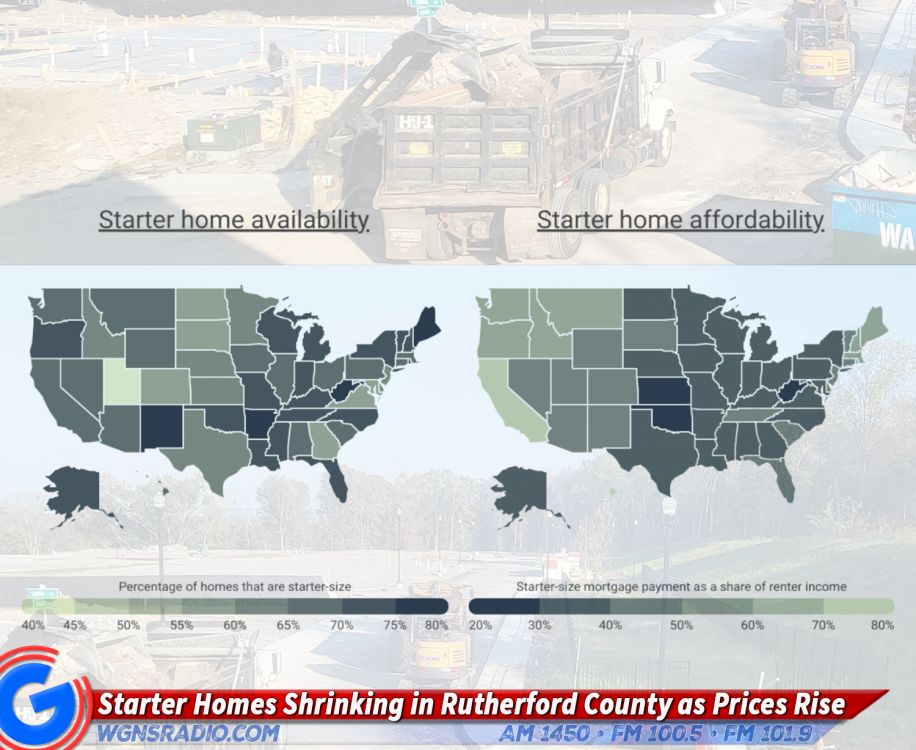

MURFREESBORO, Tenn. – The pathway to the American dream of homeownership is becoming increasingly narrow for residents of Murfreesboro and the broader Rutherford County area, where rising prices and limited inventory are squeezing out first-time buyers. In fact, it's a problem that spans a much larger area than Tennessee as historically low levels of home inventory at entry price points continues to grow making homeownership in the U.S. an uphill battle for a huge percentage.

A new housing report analyzing metro areas across the United States ranks the Nashville-Davidson–Murfreesboro–Franklin Metropolitan Statistical Area (MSA) at #222 out of 334 U.S. markets in terms of affordability and accessibility for starter homes in 2025. That’s a steep drop from its #146 ranking just three years ago in 2022, indicating a significant decline in housing affordability for middle- and lower-income families.

Locally, the signs of this shift are evident. The median price of a home in 2025 has climbed to $392,083, with only 41.6% of these homes qualifying as having a “starter-size” mortgage payment—defined as one that a household earning the median renter income can reasonably afford. At the same time, 68% of homes on the market are considered “starter size,” reflecting the right square footage, but not necessarily the right price.

A Difficult Market for Young Buyers - While many younger buyers once looked to Murfreesboro as a more affordable alternative to Nashville, the area is no longer the safe haven it once was. The homeownership rate for those under 35 in the metro area is just 35.7%, well below national averages from previous decades.

The issue is not just about high prices, but about the fundamental mismatch between housing supply and demand. The inventory of homes has increased to a 3.8-month supply in 2025—up from 2.5 months in 2022—but this modest improvement hasn’t been enough to curb prices or alleviate competition among buyers.

Between 2000 and 2023, inflation-adjusted home prices nationally rose by 56.5%, while median household incomes increased by just 8.5%. That income-price disparity has affected local markets like Murfreesboro significantly, where wage growth hasn’t kept pace with real estate values.

Larger Homes Dominate New Construction - The supply problem is exacerbated by trends in new construction. Fewer than 5% of newly built homes today are two-bedroom units, a category typically aligned with starter homes. In contrast, 51% of new builds feature four bedrooms, catering more to growing families or higher-income buyers than entry-level homeowners. Even the share of three-bedroom homes—once the standard for first-time buyers—has dropped over time.

This construction trend creates a shrinking pool of affordable, appropriately sized homes for younger buyers or those entering the market for the first time. It also limits housing options for retirees and downsizers, who might also seek smaller, more manageable living spaces.

How Murfreesboro Compares to Other Tennessee Cities - When comparing Murfreesboro to other metro areas within Tennessee, the affordability gap becomes even clearer. Of the seven ranked metro areas in the state, Murfreesboro–Nashville–Franklin placed last.

In contrast, the Kingsport-Bristol area in East Tennessee ranked #1 in the state and #28 nationwide, thanks to a more balanced market. In Kingsport and Bristol:

- 79.4% of homes are considered starter-sized,

- The median price of a starter home is $219,805, and

- The homeownership rate for those under 35 is 55.6%, significantly higher than Murfreesboro’s.

The affordability and availability of homes in cities like Kingsport are helping maintain a strong base of young homeowners—something Murfreesboro may struggle to replicate without a change in market dynamics or local policy.

A Closer Look at Where TN Cities Rank Locally and Nationwide (U.S.):

| Tennessee City and TN Ranking | U.S. Rank | *Composite Score |

% of Starter Size Homes |

| 1. Kingsport - Bristol, TN | 28 | 76.7 | 79.4% |

| 2. Cleveland, TN | 65 | 67.3 | 76.3% |

| 3. Johnson City, TN | 71 | 66.4 | 77.3% |

| 4. Clarksville, TN | 118 | 58.2 | 69.7% |

| 5. Memphis, TN | 174 | 48.7 | 62.0% |

| 6. Knoxville, TN | 201 | 44.4 | 69.9% |

| 7. Nashville - Davidson Murfreesboro - Franklin, TN |

222 | 40.3 | 68.0% |

*Composite Score is a score based on the percentage of homes with three or fewer bedrooms (40% of the score), the monthly starter-size home mortgage payment as a percentage of median renter income (20%), median sale price of homes with three or fewer bedrooms (15%), supply of homes (15%), and the homeownership rate for under-35 householders (10%).

Market Snapshot - Nashville, Davidson – Murfreesboro – Franklin, TN MSA:

Recent Listing Activity:

Between March 3, 2025, and May 25, 2025, Redfin reports 995 new real estate listings in the local MSA—representing a 7.6% increase compared to the same period in 2024.

Current Sales Trends:

Despite the rise in listings, pending sales have declined by 3.4% year-over-year. Similarly, the number of homes actually sold during this time frame is down 4.8% compared to 2024.

Days on Market & Speed of Sale:

Closings appear to be taking slightly longer in 2025, with transactions potentially delayed by 1 to 3 days compared to the same period last year. Still, 21% of listings go off the market within two weeks, a slight dip from 22% in 2024.

Inventory Levels:

The number of active listings is up significantly—19.54% year-over-year. As of late May 2025, there are 11,601 homes for sale in the MSA, compared to approximately 9,334 during the same period last year.

Home Prices:

The median price per square foot in the Nashville/Murfreesboro/Franklin area is currently $243.12, a modest increase of 0.47% over last year.

-

A typical 2,500 sq. ft. home now sells for around $607,800 (median price).

-

A 1,500 sq. ft. starter home averages approximately $364,680 (median price).

Despite the minor up swings seen in recent months, the higher interest rates today compared to mortgage interest rates two years ago, are continuing to make buying more unaffordable than before.

Nationwide Outcome of Overall Data: The study reveals that West Virginia ranks as the best state in the U.S. to find a starter home, followed closely by Mississippi and Oklahoma. In these states, starter-size homes account for over 70% of the total housing stock, and they remain relatively affordable compared to national averages. Similar patterns are evident in several Southern and Rust Belt metropolitan areas, where starter homes are both more prevalent and accessible.

However, it's important to note that this data reflects housing availability and affordability only. It does not imply that these states or cities are the best overall places to live, raise a family, or build a long-term career, as other critical factors such as employment opportunities, economic growth, education, and quality of life were not part of the study's focus.

What Are the Rust Belt States? Illinois, Indiana, Michigan, Missouri, New York, Ohio, Pennsylvania, West Virginia, and Wisconsin are considered to be part of the Rust Belt. These states were part of the manufacturing center of the United States, employing a large part of the population in manufacturing jobs.

Looking Ahead - Despite the challenges, Murfreesboro remains one of the most vibrant and fastest-growing communities in Tennessee. Its schools, job market, and proximity to Nashville continue to attract new residents. However, without focused efforts to increase the supply of affordable homes, especially for first-time buyers, the city risks losing a key part of what made it attractive in the first place.

Local governments and developers may need to reconsider zoning regulations, encourage more diverse housing types, and explore incentives for building smaller, lower-cost homes. Additionally, expanded access to down payment assistance or first-time homebuyer programs could help offset financial barriers.

As Murfreesboro and Rutherford County continue to grow, balancing development with affordability will be essential to preserving the area's accessibility and appeal for generations to come.

Need More Details? Check Out: The Best U.S. Cities to Find a Starter Home [2025 Edition]