We have more news on rent prices in Tennessee. Rising rents have hit households hard over the last year. After remaining flat amid eviction moratoriums and government assistance programs in 2020, rents grew by 17.6% in 2021 and by another 6.7% over the first seven months of 2022. And in a period of persistent inflation, costs for housing are squeezing renters’ budgets for other household spending.

Spending no more than 30% of one's earnings on rent, the wage needed to rent a one-bedroom unit in Tennessee is $32,000 per year—1.8% more than the median annual wage of $31,414 for millennial renters there.

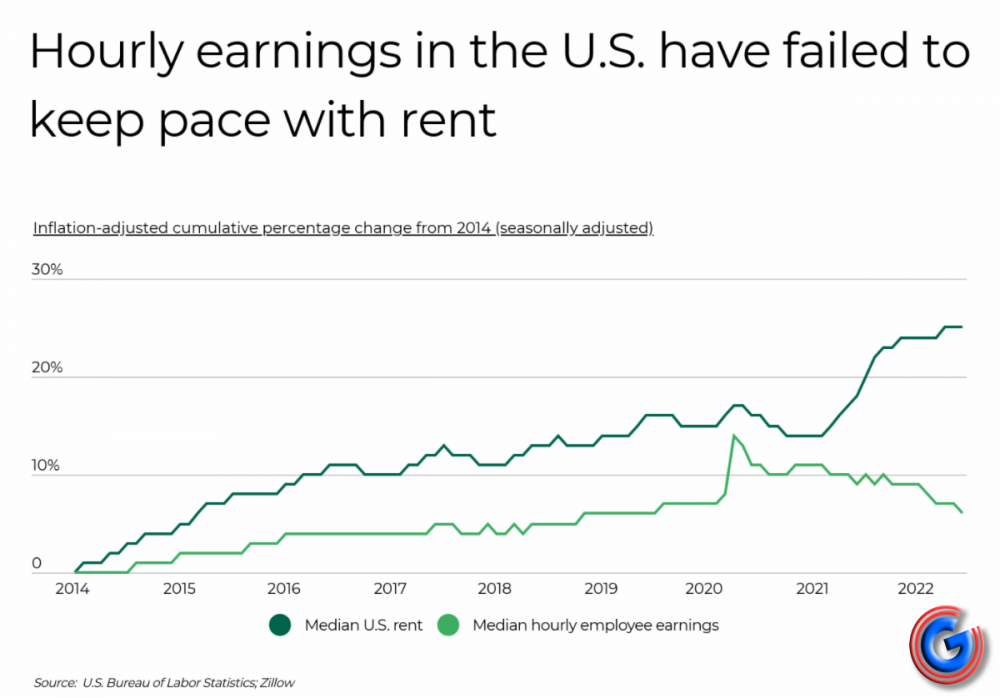

But even before the recent spike in rents, the gap between what a typical rental costs and what the typical worker can afford based on their income has been growing. Amid stagnant wages for workers, especially low income earners, and a nationwide shortage of housing stock, renters are finding it more difficult than ever to secure affordable housing. A recent report from the National Low Income Housing Coalition found that the typical renter today needs to earn $21.25 per hour to afford a modest one-bedroom apartment.

Rising rents have hit households hard over the last year. After remaining flat amid eviction moratoriums and government assistance programs in 2020, rents grew by 17.6% in 2021 and by another 6.7% over the first seven months of 2022. And in a period of persistent inflation, costs for housing are squeezing renters’ budgets for other household spending.

But even before the recent spike in rents, the gap between what a typical rental costs and what the typical worker can afford based on their income has been growing. Amid stagnant wages for workers, especially low income earners, and a nationwide shortage of housing stock, renters are finding it more difficult than ever to secure affordable housing. A recent report from the National Low Income Housing Coalition found that the typical renter today needs to earn $21.25 per hour to afford a modest one-bedroom apartment.

Current challenges in the rental market are also being experienced differently across generations. Members of the millennial generation—currently aged 26 to 41—are at an age when most people buy their first or second home. But rising costs of rents and real estate have compounded on other financial difficulties faced by the millennials, like lost earning potential after the Great Recession and historically high levels of debt. Now, 27.2% of millennials in the U.S. are renters, a larger proportion than any other generation.

For millennials in some parts of the country, rental units fortunately remain relatively affordable. The interior of the U.S. tends to have the most affordable locations, including 13 states where a typical millennial renter’s earnings exceed what is needed to afford the median one-bedroom unit. In contrast, most of the states where millennials have larger renter wage gaps are coastal states that tend to have higher housing costs due to limited supply, like California. The problem is even more acute at the metro level, where some of the most desirable and fastest-growing cities in the U.S. have major renter wage gaps for millennials.

To determine the locations with the largest millennial renter wage gap, researchers at Filterbuy calculated the percentage difference between the median wage for millennial renters and the median wage necessary to afford a one-bedroom rental without spending more than 30% of wages on rent. In the event of a tie, the location with the higher median one-bedroom rent was ranked higher.

The analysis found that the wage needed to rent a one-bedroom unit in Tennessee is $32,000 per year—1.8% more than the median annual wage of $31,414 for millennial renters there. Here is a summary of the data for Tennessee (see even more details on rent prices in Murfreesboro, Smyrna and Nashville HERE):

- Millennial renter wage gap:-1.8%

- Millennial renter median wage:$31,414

- Annual wage needed to afford a 1-br rental:$32,000

- Median 1-br rent:$800

- Percentage of millennials in rented housing:3%

For reference, here are the statistics for the entire United States:

- Millennial renter wage gap:-20.6%

- Millennial renter median wage:$34,555

- Annual wage needed to afford a 1-br rental:$43,547

- Median 1-br rent:$1,089

- Percentage of millennials in rented housing:2%

For more information, a detailed methodology, and complete results, you can find the original report on Filterbuy’s website: https://filterbuy.com/resources/cities-with-largest-millennial-wage-gap/

Additional News Headlines You May Have Missed on WGNS:

1.) Median Price of Homes in Rutherford Co. UP in 1st Quarter and Start of Q2

2.) Students moved into the MTSU Dorms this past weekend